丹斯里李金友被指洗黑錢1.2億,劉錦坤被控逃稅5億;現在輪到劉叔權中招,被指漏稅8千萬!為何專針對華商卻不對付逃稅的馬來商人?納吉緊盯華商錢包惹眾怒!

憤怒!內陸稅收局繼續瞄準華裔企業錢包,又一個華裔企業家中槍!被所得稅局追討8千萬逃稅!

丹斯里李金友被指洗黑錢1.2億,劉錦坤被控逃稅5億;現在輪到劉叔權中招,被指漏稅8千萬!為何專針對華商卻不對付逃稅的馬來商人?納吉緊盯華商錢包惹眾怒!

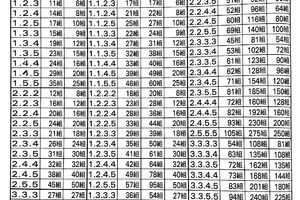

這回中槍的是由華裔企業家劉叔權領導的上市公司MK Land。他被內陸稅收局指控分別在2009年至2011年,還有2013年涉及逃稅5570萬令吉,加上45%罰款2507萬,總共必須繳納8077萬稅務,否則將會被起訴。

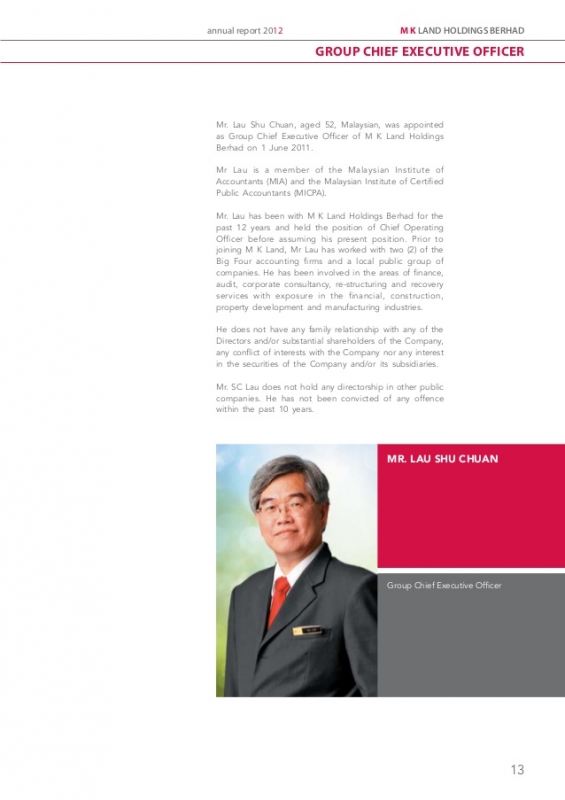

劉叔權(譯音)本身是一名特許會計師,掌舵MK Land已經超過8年。

他是繼綠野集團的丹斯里李金友及萬能企業的丹斯里劉錦坤之後,第三位被納吉政府盯緊錢包的華裔企業家。丹斯里李金友被所得稅局指控涉及洗黑錢不發活動,他存在外資銀行戶口的一筆1.2億存款被強制凍結;而丹斯里劉錦坤則被指逃稅5億,被內陸稅收局立案調查。

跟李金友及劉錦坤一樣,劉叔權也怒髮衝冠指責內陸稅收局的指控純屬莫須有,將委託律師抗辯到底。

企業界都對納吉政府發窮惡的行為感到不滿,尤其是追查漏稅的罪名形同侮辱華裔商人的企業信譽。令人詬病的是為何追討漏稅的行動只針對華裔商家?馬來商家拒絕繳交稅務的不當行為是企業界公開的秘密,為什麼放著一大堆犯法的馬來商家不對付,卻專針對華裔企業家雞蛋裡挑骨頭?羅織各種莫須有罪名打壓非土著企業家的偏頗行為,只會嚇跑外國投資者,對國家經濟發展一點好處也沒有!

針對MK Land的漏稅指控,真相其實是頗有爭議的。MK Land在2011年將屬下一段產業地皮變賣了,按照企業法令規定,這筆買賣的盈利屬於資本套現,是可以豁免所得稅的,當年呈報時,所得稅局也沒表示有任何問題,但是時隔6年了,現在內陸稅收局卻說這筆買賣收入不得列為資本套現,而必須改為資產盈利所得,因此必須繳稅。更不由分說的列出MK Land必須補繳一筆5千多萬的稅收,另外加上2千多萬罰款,總共必須補繳8077萬令吉。

內陸稅收局的這項舉動,對身為特許會計師的劉叔權來說,簡直就是侮辱。他認為非常不合理,因此決定據理力爭,抗辯到底。

M K Land gets surprise tax bill, fine totalling RM80.77mil

KUALA LUMPUR: M K Land Holdings Bhd has become the latest public-listed group to announce the receipt of a surprise tax bill from the Inland Revenue Board (IRB).

In a filing with Bursa Malaysia on Monday, the company said wholly owned subsidiary Saujana Triangle Sdn Bhd (STSB) -- the developer of its flagship Damansara Perdana project in Petaling Jaya -- had been served with notices for an additional income tax of RM55.7mil and a 45% penalty of RM25.07mil.

The tax bill of RM80.77mil is in relation to years of assessment 2009-2011 and 2013.

M K Land said the IRB decided to impose the additional income tax and penalty for three reasons.

One, it considered the gains from the disposal of land held under Investment Properties in year of assessment 2009 as revenue in nature, instead of capital in nature.

The IRB has also disregarded the five-year time barred period to raise the said assessments in respect of the land disposal.

Finally, the IRB has disallowed certain development costs on the basis that these were only provisions and the amounts had yet to be paid. Thus it does not treat them to be incurred for the purpose of Section 33 (1) of the Income Tax Act, 1967 (as expenses that qualify for tax deduction).

M K Land said STSB disagreed with the assessments raised by the IRB and would therefore appeal.

Based on the advice from both its tax consultants and lawyers, STSB felt the land sales of the Investment Properties were capital transactions that were liable to real property gains tax (RPGT) in year 2009 (tax-exempt year).

(From April 2007 until the RPGT was reinstated on Jan 1, 2010, all gains from property transactions were exempted from the tax.)

In addition, STSB is of the view that the notices of assessment raised are statute barred and erroneous in law.

Further, according to STSB, the accrual of development costs has been allowed according to accounting standards and IRB’s public ruling on property development.

M K Land said it would make further announcement if there was any material update.