快来看啊!我们今年的公积金EPF派息率跟国际油价一样狂跌了!跌倒剩下不足5%,会员看到都要哭了。。

今年全国1400万公积金会员肯定笑不出来了。根据有关方面的消息指出,公积金局在2015年的投资收入估计只能跟2014年持平,但派发的利息却只有介于4.5%到5.2%之间,远远比去年的6.75%少了1.5%以上!如果你在EPF的存款有10万令吉,意味着你比去年少赚了RM1,500令吉!

1500令吉算多吗?当然算多!因为首相纳吉不断高调强调,国人每月只需区区RM300就足够应付生活开支;按照纳吉的说法,1500令吉就等于人民平白不见了5个月的生活费!会死人的咯!

讽刺的是,踏入2016年,国内好几家银行不约而同宣布调高定期存款利率,有者年利甚至超过4%。这样讲的话,与其继续把钱放在公积金,不如提起来放进银行当定存更安全了。因为国家已经没钱,许多巫统政棍和朋党无时无刻都在打公积金的主意,虎视眈眈找机会从EPF搬钱。坊间早已盛传那些朋党总共已经挖走了公积金局高达4000亿令吉,而公积金局的总存款额是6672.1亿令吉,换句话说,超过三份之二的会员退休金很可能已经不翼而飞咯。

公积金局去年初宣布,2014全年总共赚得RM390.08亿令吉,所以2015年初派发6.75%利息给所有会员,相等于366.6亿令吉。

但是2015年的大马经济情况一团糟,贪污丑闻越闹越大,国家的钱不见了,外资走了,股市连连下挫了,国际油价狂跌了,马币兑换率狂泻了。。。种种内忧外患之下,公积金局的投资所得也大幅度缩水,被迫变卖手头上持有的大批蓝筹股套现,才保住了净利的额度。2015年首三季度财政报告显示,公积金局的净利为315.8亿令吉,估计加上第四季度,勉强可以取得390亿令吉左右的盈余。

公积金局首席执行员拿督沙里尔理查对媒体表示,公积金局已经尽力了,奈何国际经济局势严苛,大势所趋,他也无能为力。

当然,听到他这样讲,看到大幅滑落的利息,人民也倍觉无力了。。。

EPF dividends projected at 4.5% to 5.2%

Economists have projected that the Employees Provident Fund (EPF) will announce a lower dividend rate of between 4.5% and 5.2% for 2015 compared with 6.75% for 2014 on weaker investment climate due to slower global and domestic economic growth.

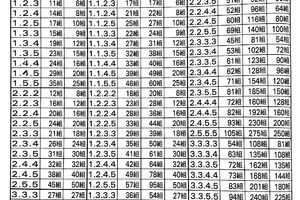

EPF recorded RM39.08 billion gross investment income for financial year ended Dec 31, 2014. The 6.75 per cent dividend amounted to a total payout of RM36.66 billion where RM5.41 billion was required to pay every one per cent of dividend rate for 2014.

Its investment income for the first three quarters of 2015 has totalled RM31.58 million. Its expected investment income for 2015 is likely to surpass its RM39.08 billion gross investment income for financial year ended Dec 31, 2014.

On Nov 20, EPF announced investment income of RM9.54 billion for the third quarter of 2015 (Q3 2015) ended Sept 30, 2015, a year-on-year decline of 7.58 per cent.

“This third quarter had been challenging for the EPF as the uncertainties in the market heightened,” EPF Chief Executive Officer Datuk Shahril Ridza Ridzuan said then. “Nevertheless, our global diversification programme helped cushion the impact during this period.

“We had been anticipating the difficult market conditions and adjusting our strategies accordingly. As with other investors, we were not spared by the impact. Nevertheless, we were still able to generate returns from other markets in the world when the domestic market performed lower than expected.”

EPF announced an investment income of RM11.41 billion for the second quarter of 2015 (Q2 2015) ended June 30, 2015.

As at Q1 2015, the EPF’s total investment assets stood at RM667.21 billion, an increase of RM30.68 billion for the first six months of 2015. It announced an investment income of RM10.63 billion for the first quarter ended March 31,2015.

However, economists said it would be extremely difficult for EPF to meet the year 2014 dividend rate under the current economic scenario.

“Given the current weak climate, a dividend of 4.5% to 5% would be a commendable return,” The Malaysian Reserve (TMR) quoted Malaysian University of Science and Technology dean of business Dr Yeah Kim Leng as saying.

“There were so many negatives last year. Asset prices fell and most hedge funds had weaker performances. It would likely be the same for EPF,” Prof Dr Hoo Ke Ping, a prominent economist and investment advisor, told TMR.

“A dividend of 4.8% to 5.2% will be considered good. It is important to note that this will be better than what bank deposits offer, which only range around 3%.”

Private sector workers are hoping for a higher dividend payout by EPF this year to cope with the rising cost of living and the impact from the Goods and Services Tax (GST), said the Malaysian Trades Union Congress (MTUC).

MTUC deputy secretary-general A. Balasubramaniam said the majority of the 10 million private sector workers were looking forward to a better dividend from the fund as it was the only source of savings for them.

“We have more than four million active contributors in EPF. Higher dividend would add more value to their retirement savings,” he said. “Private sector workers from the lower income group have to contend with the hike in public transportation fares and higher toll rates for certain major highways in and around the Klang Valley.

“These factors had impacted the lifestyle of workers as they hardly could save from their monthly wages and as such, EPF is the only savings they could keep for their retirement.”

There have been proposals for the authorities consider lowering the monthly EPF contribution to improve household disposable income. Another suggestion is to allow the recently retrenched to withdraw from their EPF accounts.

The reduction of workers’ EPF contributions is nothing new. From January 2009 until December 2010, employees were allowed to opt to reduce their monthly EPF contribution from 11% to 8%. The employers’ 12% contribution remained the same. The contribution rate was also reduced twice earlier – once in 2001 and the other in 2003.